Yes, car maintenance can be tax deductible. But it depends on certain conditions.

Understanding these can save you money. Car maintenance costs can add up quickly. Many people wonder if they can deduct these expenses on their taxes. The answer depends on how you use your vehicle. If you use your car for business, some expenses may be deductible.

This can include repairs, oil changes, and tire replacements. But, personal use of your vehicle doesn’t qualify. Knowing the rules can help you make the most of your deductions. Let’s dive into the details and see if you can benefit from these tax deductions.

Credit: www.goldenappleagencyinc.com

Tax Deductions For Car Maintenance

Did you know that some car maintenance expenses might be tax deductible? Yes, it’s true! Understanding tax deductions for car maintenance can save you money. This section will break down what expenses qualify, which types of vehicles are eligible, and more.

Eligible Expenses

Many car maintenance costs can be deducted, but not all. Let’s look at what qualifies:

- Oil changes

- Tire rotations

- Brake repairs

- Engine tune-ups

- Fluid refills

These expenses can be deducted if you use your car for business. Keep detailed records and receipts for all maintenance.

Types Of Vehicles

Not every vehicle qualifies for these tax deductions. Here are the types that do:

| Vehicle Type | Eligibility |

|---|---|

| Personal Cars | Only if used for business |

| Company Cars | Eligible |

| Rental Vehicles | Eligible |

Always check the specific IRS rules for more details. Use your car primarily for work? You may get more deductions.

Understanding these rules can help you save on taxes. Make sure your car maintenance is documented well. It can make a big difference!

Business Use Of A Vehicle

Using your car for business purposes can make some expenses tax-deductible. This can include car maintenance costs. To benefit, you must meet certain criteria and keep good records.

Qualifying Criteria

To deduct car maintenance, the vehicle must be used for business. This means using the car for work-related tasks. For example, driving to meet clients, making deliveries, or running business errands. Personal use does not count. Only the business portion of use qualifies for deductions.

Record-keeping Tips

Good record-keeping is crucial for claiming deductions. Keep a detailed log of business trips. Note the date, mileage, and purpose of each trip. Use apps or a physical logbook. Save receipts for maintenance expenses. This includes oil changes, tire rotations, and repairs. Organize receipts by date and type of service. This makes it easier to prove deductions if audited. Regularly update your records to avoid forgetting details.

Personal Vs. Business Expenses

Understanding the difference between personal and business expenses is crucial for tax deductions. Car maintenance costs can fall under either category. Knowing how to properly categorize these expenses can save you money and avoid issues with the IRS.

Mixed-use Vehicles

Many people use their car for both personal and business purposes. These mixed-use vehicles require special attention when claiming deductions. The key is to determine how much of the car’s use is for business and how much is personal.

| Type of Use | Percentage |

|---|---|

| Business | 60% |

| Personal | 40% |

For example, if you use your car 60% of the time for business, only 60% of the car maintenance costs are deductible.

Allocation Methods

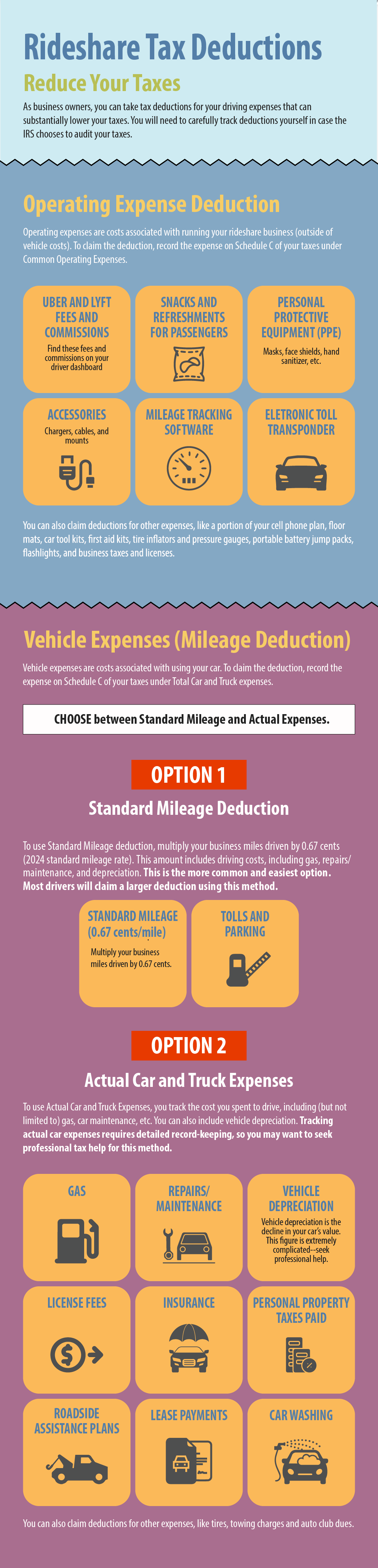

There are two main methods to allocate car expenses: the standard mileage rate and the actual expense method.

- Standard Mileage Rate: This method allows you to deduct a set amount per mile driven for business purposes. For 2023, the rate is 65.5 cents per mile.

- Actual Expense Method: This method requires you to keep track of all car-related expenses, such as gas, repairs, and maintenance. You then allocate these expenses based on the percentage of business use.

Both methods have their pros and cons. The standard mileage rate is simpler but may result in lower deductions. The actual expense method can yield higher deductions but requires more record-keeping.

Choosing the right method depends on your specific situation. Keeping detailed records will help ensure you get the most accurate deduction.

Credit: mileiq.com

Self-employed Individuals

Self-employed individuals often use their personal vehicles for business purposes. This makes it essential to understand if car maintenance can be tax-deductible. Keeping accurate records of car expenses can lead to potential tax savings.

Mileage Deduction

The mileage deduction is one way to claim car expenses. It involves tracking the miles driven for business purposes. The IRS sets a standard mileage rate each year. Multiply your business miles by this rate to calculate your deduction.

For instance, if you drive 1,000 miles for business, and the rate is 58 cents per mile, your deduction would be $580. This method is simple but requires a detailed mileage log. Use apps or a notebook to keep track.

The actual expense method allows you to deduct the actual costs of using your car for business. This includes gas, oil changes, repairs, insurance, and more. You need to keep all receipts and records of these expenses.

Calculate your business use percentage of the car. If 60% of your car use is for business, you can deduct 60% of your total car expenses. This method can result in a larger deduction but requires more detailed record-keeping.

Employee Vehicle Expenses

Employees often use their vehicles for work purposes. These trips may include client visits, deliveries, or work-related errands. Employees may incur various expenses. Gas, repairs, and maintenance are some examples. Understanding tax deductions on these costs is vital. It can help save money.

Reimbursement Policies

Many companies have reimbursement policies. These policies cover employee vehicle expenses. The employee submits receipts for costs. The company then reimburses these expenses. This process ensures employees are not out of pocket. Clear guidelines help both parties. It avoids confusion and ensures smooth reimbursement.

Taxable Benefits

Reimbursements may be taxable. The IRS has specific rules. Reimbursements for personal use of a vehicle are taxable. Only business-related expenses are tax-free. Accurate records are crucial. They help in identifying deductible expenses. This clarity ensures compliance with tax laws.

Standard Mileage Rate

Understanding the standard mileage rate is crucial for car-related tax deductions. This rate, set by the IRS, allows taxpayers to deduct business-related driving expenses using a per-mile rate.

Calculation Methods

The IRS provides two main methods for calculating mileage deductions:

- Standard Mileage Rate: Multiply the total business miles driven by the IRS rate.

- Actual Expense Method: Calculate actual costs including gas, repairs, and insurance.

Most taxpayers find the standard mileage rate simpler. It requires less record-keeping and fewer calculations.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

The standard mileage rate can simplify tax reporting. Weighing the pros and cons helps you choose the best method.

Actual Expense Method

The Actual Expense Method offers a way to claim car maintenance as a tax deduction. This method allows you to deduct specific costs. The more accurate your records, the better your tax benefits. You need to track each expense related to your vehicle. Two key areas include detailed expense tracking and depreciation.

Detailed Expense Tracking

Keeping detailed records is essential. Track all car-related expenses. This includes gas, oil changes, and repairs. Parking fees and car washes also count. Keep receipts for every expense. Accurate records help you claim the maximum deduction. Use a logbook or digital app for tracking.

Depreciation

Depreciation is another factor. Your car loses value over time. You can deduct this loss in value. The IRS has specific rules for calculating depreciation. Use the IRS guidelines for accurate calculations. Include the depreciation amount in your total expenses. This boosts your possible deduction.

Record-keeping Best Practices

Keeping accurate records is key to claiming car maintenance as a tax deduction. Proper documentation can help you get the most from your tax returns. It also ensures you stay compliant with IRS requirements.

Documentation Requirements

To claim car maintenance as a tax deduction, you need to maintain detailed records. Include the following:

- Receipts for all car-related expenses

- Mileage logs for business trips

- Invoices from mechanics

- Any other proof of payment

Organize these documents in a folder. This makes it easy to access during tax season. You may also want to scan and save digital copies. This ensures they are safe and easy to retrieve.

Software Tools

Using software tools can simplify record-keeping. They help you track expenses and mileage effortlessly. Here are some popular options:

| Software | Features |

|---|---|

| QuickBooks | Expense tracking, Mileage logging, Receipt scanning |

| Expensify | Automated expense reports, Receipt scanning, Mileage tracking |

| Zoho Expense | Expense management, Receipt scanning, Mileage tracking |

These tools are user-friendly. They save time and reduce errors. Choose one that fits your needs and budget. Many offer free trials. This allows you to test them before committing.

Credit: triplogmileage.com

Frequently Asked Questions

Can Car Maintenance Be Tax Deductible?

Yes, car maintenance can be tax deductible if used for business purposes. Keep detailed records of expenses.

What Car Expenses Are Tax Deductible?

Business-related car expenses like repairs, maintenance, fuel, and insurance can be tax deductible. Always keep receipts.

How To Claim Car Maintenance Tax Deduction?

To claim, use Form 2106 or Schedule C. Track all business-related car expenses and mileage.

Are Personal Car Repairs Tax Deductible?

No, personal car repairs are not tax deductible. Only business-related car expenses can be deducted.

Conclusion

Understanding if car maintenance can be tax-deductible is important. It depends on your situation. Business use of a car often qualifies. Personal use usually doesn’t. Keep detailed records of expenses. Consult a tax professional for advice. This ensures you’re following the law.

Save money where you can. Proper car maintenance keeps your vehicle running smoothly. It also helps avoid costly repairs. Combining good record-keeping with professional advice is key. Make informed decisions about your car expenses. Stay compliant and maximize potential deductions.